Virginia State Estimated Tax Payments 2025

Income tax brackets and rates depend on taxable income and residency status. The federal or irs taxes are listed.

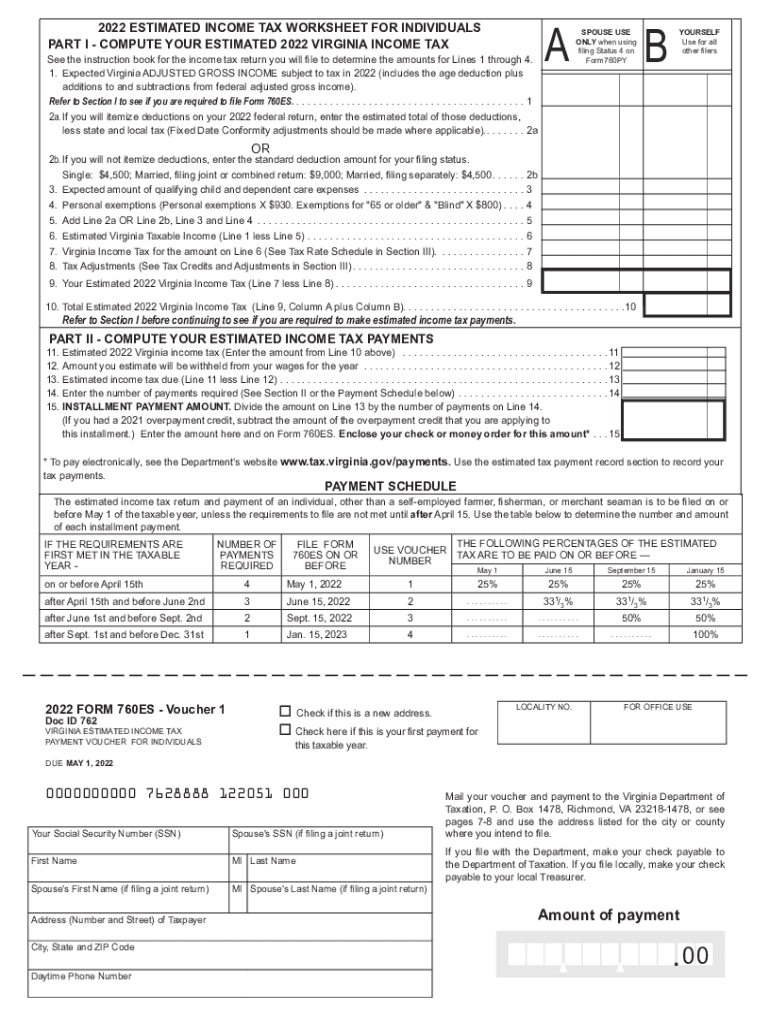

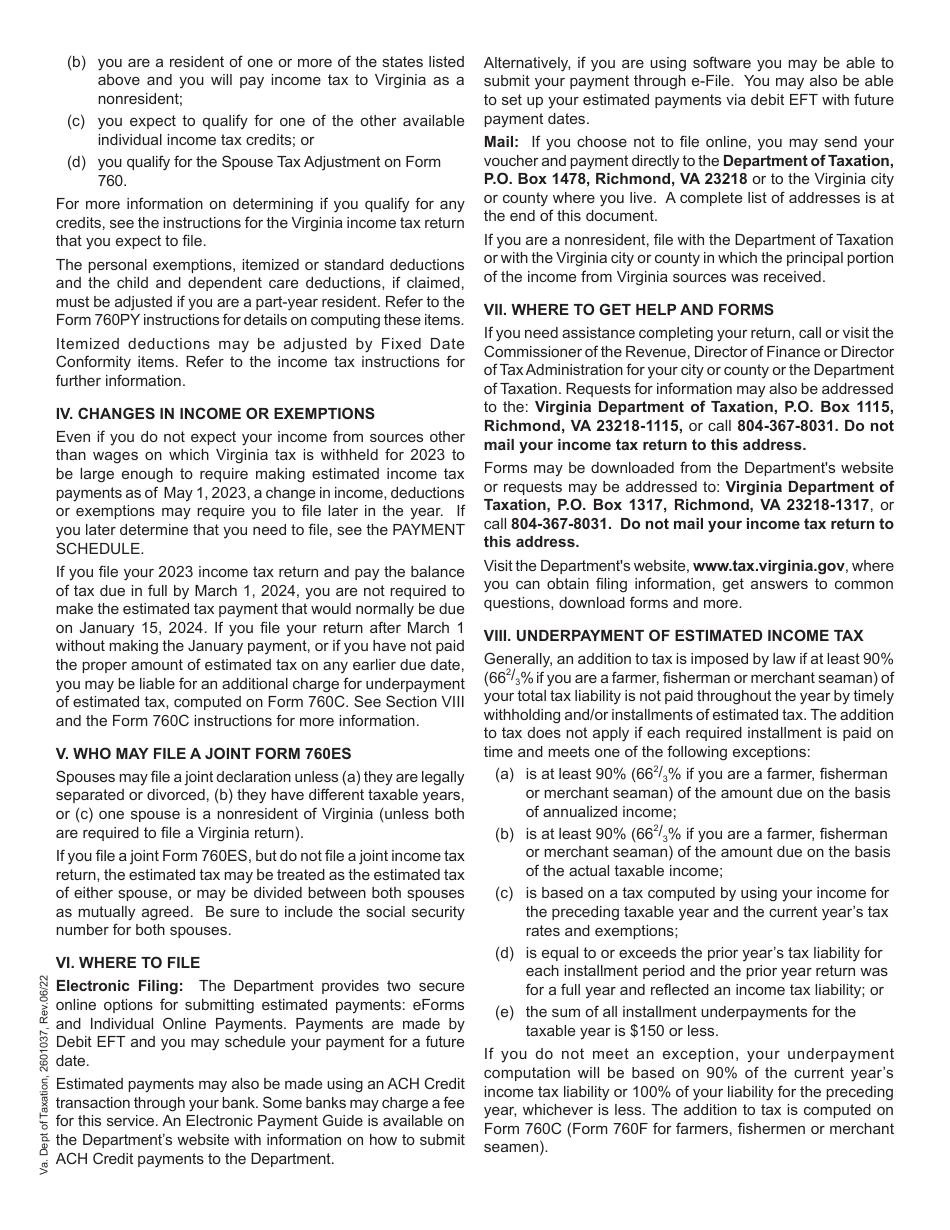

Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must.

Virginia Estimated Tax Payments 2025 Online Imelda, Income tax brackets and rates depend on taxable income and residency status. For more information about filing requirements and how to estimate your taxes, see individual estimated tax payments.

Virginia Estimated Tax Payments Due Dates 2025 Judye Marcile, Those who have not received a tax bill for their property, and. For income earned in 2025, you’ll make three payments in.

Virginia State Estimated Tax Payments 2025 Dasya Ysabel, Estimated tax deadline for virginia 2025 estimated tax payments are made: Please enter your payment details below.

2025 Virginia State Tax Calculator for 2025 tax return, If you don't have an account,. Use the following options to make estimated tax payments.

Virginia Estimated Tax Payments 2025 Online Donna Maureene, See 760es for the amount to. You can simply disregard the vouchers if you prefer;

Virginia Estimated Tax Payments 2025 Online Rae Leigha, The federal or irs taxes are listed. The virginia tax calculator let''s you calculate your state taxes for the tax year.

Virginia Estimated Tax Payments 20222024 Form Fill Out and Sign, Those who have not received a tax bill for their property, and. The state of virginia has a progressive income tax, with rates ranging from 2% to a top rate of 5.75%.

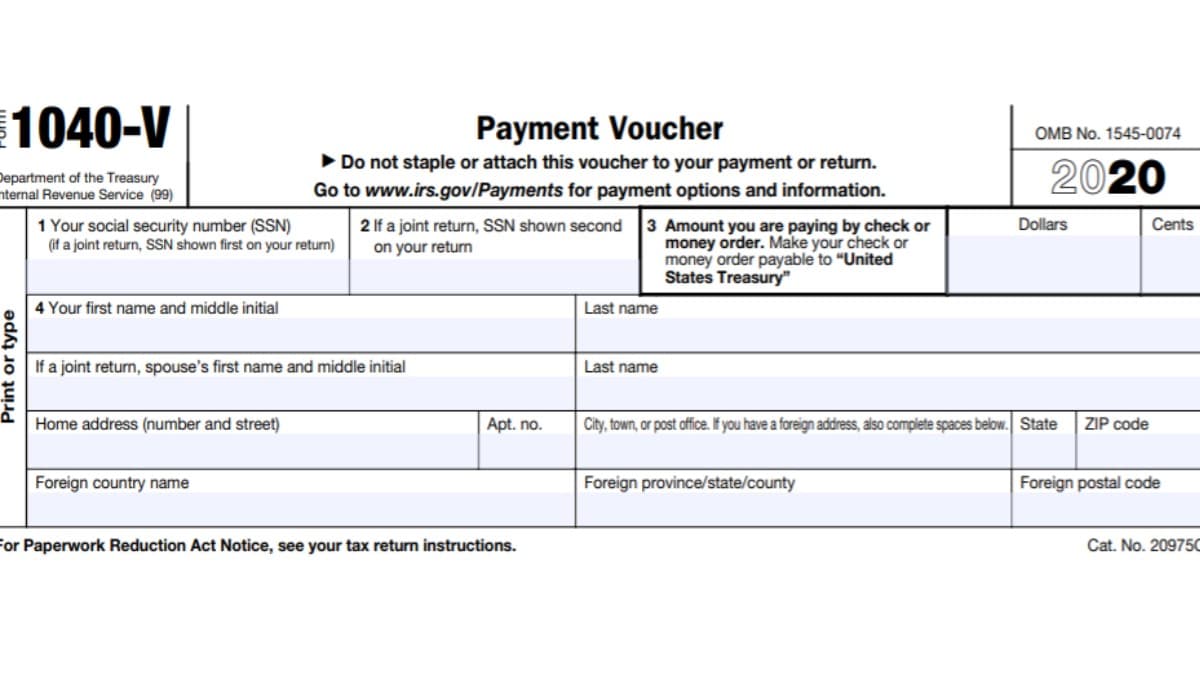

Estimated Tax Payments 2025 Forms Jorie Malinda, Virginia estimated income tax payment vouchers and instructions for individuals. Choose one of these options:

Form 760ES Download Fillable PDF or Fill Online Virginia Estimated, See the department of taxation's estimated tax and extension payments page on their website to use the 760es payment voucher form to file estimated payments. Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments.

Irs Estimated Tax Schedule 2025 Deni, Choose one of these options: We offer multiple options to pay estimated taxes.

The virginia state budget provides for an increase to the tax on liquid nicotine products from a rate of $0.066 per milliliter of liquid nicotine to $0.11 per milliliter of liquid.

The state of virginia has a progressive income tax, with rates ranging from 2% to a top rate of 5.75%.